Latest Blog on topic Transparent taxation honouring the honest, Transparent taxation in Hindi and Transparent taxation scheme in detail. so here is detail blog on the new TAX scheme in India on 13 August by pm Modi. Let’s know about Transparent taxation in detail and Transparent taxation kya hai. let’s read it completely.

Table of Contents

Transparent taxation- honoring the honest in Detail

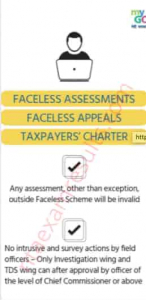

Well, the government today has rolled out measures aimed at making the income tax collection process more transparent, curbing harassment of taxpayers, and providing a faceless mechanism for assessment and appeals.

Transparent Taxation Portal launched by the prime minister. The transparent tax portal also coincides with the unveiling of the tax charter which was promised in the union budget.

So let me take you through some of the details- first the government has unveiled the faceless assessment scheme: it aims to eliminate the taxpayer tax ban interface and curb overreach by officials. The scheme also does away with territorial jurisdiction this means that a taxpayer’s assessment order review and finalization will take place in cities where he or she is not necessarily located .

Transparent taxation meaning || What is Transparent taxation 2020

the prime minister says the program will give the taxpayer a sense of fairness and fearlessness .secondly, the government would also be rolling out the faceless appeals system from the 25th of september. under this an appeal case will be randomly allotted to any tax officer across india and his or her identity shall remain unknown .

however serious frauds major tax evasion ,sensitive and search matters have been kept out of the ambit of the faceless appeals .the system also excludes international taxation and black money act as well as the benami property act .

thirdly as promised in the budget the taxpayers charter is finally here it lists out commitments of the tax department towards the taxpayer ,the charter says the tax department should treat taxpayers as honest unless there is a reason to believe .otherwise it also articulates taxpayers rights and responsibilities and sets out the government’s expectations from them.

https://youtu.be/izgt4klKXx0

there are only three other countries in the world which have enshrined the rights of taxpayers that’s canada, u.s and australia . the question that we’re asking today are all of these measures enough to give a philip to india’s tax base just so ,you know there were 8.45 crore taxpayers in fy 19 .

also what message does this send out across the tax department to discuss that and more we are joined by some of india’s best-known tax experts but before we get to them listen in to the prime minister faceless, well that is the prime minister on the taxpayers charter as well as the transparent tax portal both being unveiled .

Today joining us now rajiv mehmani chairman and managing partner for eva india dinesh khannabad .the sea of druva advisors and hitesh gajari the partner and head of tax at kpmg gentlemen appreciate you joining us here on the Website.

PM @narendramodi to launch the platform for “Transparent Taxation – Honoring the Honest” on 13th August 2020.https://t.co/ZEsJFfbeUn

— PMO India (@PMOIndia) August 12, 2020

via NaMo App pic.twitter.com/Ep91rc2Ovg

Transparent taxation kya hai, Transparent taxation ka Matlab

Rajiv let me start by asking you you were also a member of the task force on direct taxes that submitted its report to the finance minister last year in light of what we’ve seen the tax department unveiled today both with the tax charter as well as with the transparent tax portal .this ambition of making the entire process painless seamless and faceless. what is it going to mean on the ground so uh sharing i think this these are uh very massive and very big changes that have come .

i think they’ve been in the works i think it’s been formally launched uh by the prime minister today and i think his summary of the situation was very very accurate. uh so i so i would say what really changes is firstly for that if you actually look at it from a tax uh department standpoint from the revenue authority standpoint .i think this is a massive change the the the process the entire way in which assessment was done historically .

i think that completely changes uh you know earlier they would sit you know a lot of clarifications were done you could sit across the table and you know you could get a lot of clarifications done. now that that changes the the job of the assessing officer, now has been broken into many parts .so apart from being faceless i mean there are separate units, so how the teaming amongst those units happen uh that changes uh quite a bit plus.

Transparent taxation in hindi, Transparent Taxation scheme in hindi

the important point is the reliance on technology ,so whether as the both the finance minister and the prime minister mentioned, whether it is a AI or whether it is ml with whether it’s data and everything and the level of analytics that they will be going into .so i think it’s a very bold step.

i think it’s a very positive step and it’ll have a big change in the revenue authorities for them to understand and make this change happen is also going to be one of the challenges and one of the key things on how this successful this is at. the same time i think this entails a big change for for for uh whether corporates or individuals for all sscs it’s a massive change because historically again.

uh you know they would you know you file the return you know if there were any questions you would sit across the table you would resolve it you would probably know who your assessing officer or the structure is so, sometimes even technical calls that people took was also had some knowledge. now they have no knowledge of that, plus given the technology infrastructure that the revenue authorities are building .

i think it’s very important for these sscs also be to thinking around saying you know how do they cope up with it you know how do they ensure today. they have to the gst reconciliation how do they ensure that their customs and their you know return numbers actually fully reconcile if there any stock exchange filings, how are those reconciliations happening is there any filings with roc .how’s that reconsideration?

Transparent taxation scheme 2020 News in hindi

uh how is that going to happen so because that’s exactly what the tax authorities are going to look at it when you get comments uh from the when you this thing you know the responses again will have to be very crisp very data-lit and also earlier you could file in greens and reams of papers. now it will be much more shorter you could you could cite ,you know 100 case laws now you have to cite very few of them and everything else so that again taking adjournments and others which was easier earlier is going to be more challenging. so i think the level of preparation both from a technology, standpoint the level of preparation in filing the returns dealing with this on a very timely basis .

and when things come back from the department just to be very crisp clear and responding so i think this is a big change for everyone this is a big change for the redmi authorities this is a big change for corporate india or for individual sscs and i think it’s a very positive change because this is one of the things that we were asking and finally sharing one of the questions which which i still you know.

i’m not hundred percent clear but you know one of the questions if you look at the earlier reports there was always this question of revenue targets that various jurisdictional assessees had now the assessment will be done at a completely different jurisdiction although eventually post assessment pieces will be dead by the jurisdictional.

ssc but the entire some of the high pitched assessments that happened some of the things that came at the last moment partly were also because of the revenue targets that was there and i think so that also we’ll see how that change impacts this and i think it’s a very again ,i would say you know this was one of the issues that we were always raising that this disconnect sometimes you know harassment maybe on both sides disconnect and and other things that happened absolutely this in a way changes and in a very positive way .

i think anything that relies heavily on technology generally i always view that as a positive change because it’s more objective it’s more factual and more detailed it’ll really hate the honest players but i think equally for those people who are not fully complying with law or people who are taking very aggressive stance i think given the construct the way they hit it i think they will feel more challenged .

Transparent taxation higlights

okay so there is going to be a massive shift in the way that the tax department functions as well as the way that individuals and corporates function in their dealings with the tax department so it’s going to require a change on both sides but the nishkana bar on the issue of harassment and fearlessness that the prime minister spoke of the point that rajiv ahmani made as well one of the specific changes that’s happened for instance uh to deal with certain seizures which has been a huge challenge and a huge issue a red flag that corporate india has raised concerns about for years.

years now the cbd cbdt order clarifying that the survey action is intrusive the powers to conduct survey are only with the officers in the directorate of investigation uh and uh making it much more streamlined will this be something that will also give much more confidence to corporate india uh yes and no so of course sharing the fact that as as you mentioned earlier.

your assessments are not going to be done by any assessing officer who’s in your geography so as the prime minister explained you could be attacked there in bombay and somebody in coaching etc is doing your assistance therefore what will people in cities like bombay do and i think one of the things which is being envisaged is to broadband the direct rate of investigation with far more officers so that they are looking at what are the ground level realities .

how is it that one can ensure broadening of the taxpayer base which was the point with the prime minister made that we have added when the half pro tax says yes we still have a very small percentage of taxpayers on the ground and therefore the anticipation is that officers across the board will be equipped with specific knowledge of how to conduct an investigation and those also as the prime minister mentioned today now you are posting earlier like there were lucrative postings and less lucrative postings .

Pm modi on transparent taxation

now geography does not have much to do with it yeah yeah and therefore the officers who are folding investigation charge are the only guys who will carry out surveys raids etcetera okay knowledge doing that is going to be very important ,i think to the point really about harassment i think there are two three things in the chatter which are very very interesting in one sense if you see the charter is something which everybody knows there are however there is one specific point out there which got my attention with regard to accountability .

now accountability is something which has been spoken for a long long time but that accountability has not been enforced and if therefore this charter is implemented in the right spirit with accountability being imposed then the point which you made with regard to whether there is a harassment happening or not is something which will come with very often you see showing that there are raids which are carried on uh there are already items in the newspaper to say this or that caught confessions etc and three years down the line.

you see what happens with assessment is something very very different if you are able to bring in that degree of accountability then this harassment will go away and will edit correct yes uh you what you’re mentioning in the charter is point number nine uh the department shall hold its authorities accountable for their actions .

in fact let me take that forward to hitesh gajaria some of the other interesting things that the charter talks about and here’s where we will now need to see the nuts and bolts the nitty gritties the execution roadmap .

With the launch of ‘Transparent Taxation- Honoring the Honest’ platform, PM Shri @narendramodi Ji has brought in major reform in tax regulation to ensure better compliance and transparency. pic.twitter.com/3xi7INV98H

— Dr. Pramod Sawant (@DrPramodPSawant) August 13, 2020

let me pick up on point number 11 as part of the taxpayers charter hitesh which talks about providing a mechanism to lodge a complaint the department shall provide mechanisms for lodging a complaint and prompt disposal thereof.

point number 12 uh provide a fair and just system the department shall provide a fair and impartial system and resolve the tax issues in a time-bound manner now what we need is clarity on the execution roadmap so shireen .

People Reactions on Transparent Taxation Scheme

let me just step back and say that taxpayers charter or other citizens charters as they were called earlier have are not new uh they were here in 2010 i have seen i have seen in 2014 and now we’ve seen in 2020 but to my mind what is the most important difference in this charter as compared to the earlier ones.

it’s important to know that first of all this is for the first time that this comes under a particular section so a charter is actually enacted pursuant to section 119a which only came very recently on to the statute book so it has binding force of law of course section 119 says that there will be orders and rules to be prescribed so while the charter is a great statement of intent i’m sure over the next month or so ,we hope to see and we will see rules and .

orders which will actually give effect to some of the points that you mentioned from the charter holding people accountable holding the response time-bound manner the complaint to be disposed of in a time-bound manner and here let me also share with you one another important point you mentioned in the beginning that our country is perhaps the few in the world who have actually enshrined this now in the form of a taxpayer’s charter which is which has the force of law if you see the taxpayers bill of rights in the u.s .

New Tax Reform 2020 Details and Discussion

for example i am very happy today to note that some of the best principles enshrined even in the charter in the u.s have actually been borrowed from or let’s say inspired from the u.s taxpayers bill of rights and i think we are seeing a new dawn okay of exactly how assessments and behavior of the department will change of course there are outstanding officers who we’ve had great experiences with there have been not so other good experiences but hopefully now all this should be in the form of orders circulars etc which will change behavior of the department that certainly.

is the hope uh hitesh as you point out but rajiv mani let me come to you with one of the issues that the prime minister spoke of and the hope is that uh in the process of this overhaul, that we’re likely to see this will be an issue that will be addressed as well litigation and he spoke about the need to reduce litigation which has been an oft repeated intent of various governments uh you know several times over today.

we heard about the vivace viswa scheme which was the scheme that was announced in the budget to deal with direct tax disputes now what do you believe needs to be the mechanism to ensure that we actually deliver on the intent of reducing litigation sharing that’s an excellent question it’s a real challenge .

Transparent Taxation Benefits

if you ask me so i i would say one of the things and i think it was mentioned uh i think by the finance minister uh also that one of the things the first thing they have done is to obviously raise the threshold limit the number of times where the department can actually go on appeal uh in various courts .

i think that in absolute numbers i think that reduces quite dramatically the second is you know both in the indirect tax and the direct tax side introduced you know vsp and i think the hopefully this kind of clears and the pipeline a little bit so the unclogging happens to some extent and i would .

i would assume the hope will be that with faceless assessment and the way the baseless assessments would be done uh you know firstly it’s not just the assessing officer but you know uh you know many more of the it will be it’s much more team based so hopefully description is much lesser uh then there is a layer hierarchy there’s a technical unit involved there’s a review in the unit involved there’s a verification unit involved .

so it’s also up so we are many functions will get involved apart from the assessing unit so i i’m hoping that the upshot of this will be that the number of cases that will come up uh uh will be lesser and also the qualitatively they will be much more richer so i think it’s a win-win for both it’s a win for the ssc it’s a win for the revenue authorities but having said that you know uh you know in spite of this.

we still have a big big challenge to face so if you look at last 10 years or last six seven years of the various alternative dispute resolution mechanisms that the government has deadlocked so for example you had apas and and meps that were there you have a massive uh pendency there you know so i you today have almost 800 cases of apas that are pending and if i look at the last five six years you know the appearance is about 60 a year .

Transparent Taxation Pro’s and Con’s || Transparent taxation kyu

so if you actually look at that it’s a real challenge the same is true partly with mlps and the reason and i i you know what the what the honorable prime minister said today was absolutely right that you know in aps here’s an honest taxpayer who is coming who is disclosing all the facts who’s saying .

let’s have clarity let’s ensure that we we don’t have dispute going forward let’s kill the issue once for all and there also if you’re not able to solve that i think it’s a challenge the second is advanced ruling authority that was set up in almost 12 12 10 12 years back again with lot of fanfare started off very well again the tendency there is almost 450 odd cases we clear about 20 to 30 cases a year yeah so dependencies are there .

so i think i would really uh really uh make us you know strong request to the government and to ministry of finance that we need to find a way that we strengthen these teams so they can deal with the workload and also have a very close watch to say that we can deal with this because this if we can solve this piece then i think some part of the litigation gets it the other thing that what the government did earlier was this entire process of drps which were done in some form of mediation everything that’s clearly not.

what i think the government really needs to come along with the faceless assessment with a mediation proposition where immediately with the draft assessment order you can then set up an independent mediation panel where if both the sites can come in some ways negotiate and finish off the cases i you know this is the demand if you agree with it no penalty or whatever if it’s a case where there is no case of penalty you can settle it and you don’t have to go forward and there is independence in that so that it’s not taking one side or the other or the other side .

you know if we can do that then along with the initiative that the government has taken if they can strengthen the alternative resolution mechanisms if they can reframe the entire drp process along with these sort of landmark initiative that has been taken for faceless assessments and also vsp and thresholds i think we have an opportunity to solve the problem but i think this is something that because especially in many cases you know global investors others waiting for five five six six years to get their aps cleared .

we’re just waiting for five five six years doesn’t make sense because the whole promise was that this is quick this is this is the way it will be done you will have certainty it will be done in a timely fashion unfortunately we are not living up to that promise we should we should definitely do that it will send a video you’re absolutely right.

Conclusion: Transparent Taxation Honouring the honest

you’re absolutely right global investors have raised this concern repeatedly about tax certainty and tax predictability when it comes to dealing with india and hopefully some of the suggestions that you’ve raised on the program will be taken congressman’s off but dinesh kanabar one of the other things that you know that hopefully we will get more clarity on as we move forward is the roadmap to widen the tax net.

i would imagine that what has happened today should be a step in that direction you know it’s astounding when the prime minister says only 1.5 crore are paying taxes in a country of 130 crore i mean you know what is it that you would now like to see uh in light of what we’ve heard today and what this eventually means as far as widening the tax base is concerned and the hope then is that if you widen the tax base you’ll eventually be able to lower rates as well .

yeah so uh just if i could before i answer that question uh just supplement what you mentioned earlier in terms of dispute resolution because that goes in terms of widening the tax base because today what happens is when amounts are stuck up in litigation maybe people pay 20 and then the government might see some money coming in after seven eight nine years.

the question is can we have a situation where everything does not need to travel to a high court indeed the threshold levels have been put now and that but the levels are still two crores of rupees and for a large taxpayer two crores of rupees is nothing really you have that in virtually every taxpayer.

[quads id=2]

so the question is are you able to if you are able to resolve dispute your collection mechanism that’s number one number two to the issue of widening the tax but there are two three things first the government has progressively increased the threshold after which practice payable so more and more people have gone out of the tax net uh earlier there was a requirement that even if you were within the tax net you had to file a return.

now you don’t need to file a tax return at all so obviously your sscs are not there and the reason why this earlier the law actually was that you had to find a tax return and show that you were below the threshold that led to needless paperwork harassment and whatever is so that we have done away with it today therefore there is a sizable number of people who earn income below the threshold and therefore are not required to fight second.

you have a mechanic so once artificial intelligence data analytics happens and once you are able to ensure that the parallel economy runs its course out then you are going to see so again rajiv mentioned in a very different context, that you you have collation of why is it that in u.s then you see a high level of compliance not because of morality but because of the fact that there is so much data available that if you choose any how not to pay your taxes you are bound to get caught here the information is with the government, there is an annual information report which is being filed there is something on company that there is something on gst.

how does the government put all of this together yeah and finally of course we have this holy cow which for a variety of reasons we would not like to touch which is agricultural income so while the number of taxpayers is indeed very pathetic as the prime minister rightly put it the question is what are the other mechanisms we are putting in place to ensure that people who have got to pay taxes do not come out of it .

that’s something which can very easily be done using technology so hitesh let me give you the final say then because you spoke about the rules and while we await clarity on what the rules will say uh you know in light of what we’ve discussed and in light of the challenges that you foresee as we move towards execution of what has been promised what is it that you would like the rules to take care of see.

Challenges in new Transparent taxation Scheme

what i would clearly like the rules to take care of is to really hold accountability not only for things such as raids or surveys or all of that which is one extreme but also for high pitched assessments for example that there should be for example a rule which says that where you know more than 75 percent of any demand or any issue is knocked off in appellate authorities the respective officer should be held accountable.

maybe promotions of whatever should be ensured that they are in in some senses delayed for such a person who has deliberately you know gone out of the way to raise a dispute now i’m not saying penalize any honest officer but sometimes just mechanically by road people keep on making additions year after year after year .

another very important point which dinesh alluded to i don’t think india has leveraged the humongous data which we collect not only domestically but now also internationally through c by c reports etc i think there is so much potential to increase the tax base by leveraging the data that the department already has one of the things that we think we have done right which to my mind is wrong, as we have tried to widen the tax base by increasing the withholding tax exposures .

so on every remittance for example now if you even remit something out of your tax paid money under liberalized remittance scheme overseas there is a withholding tax impose that obviously gets credited against your taxes but what happens is that we are doing it the wrong way withholding taxes only increase the burden without widening the tax base to my mind more leveraging, more using data intelligently .

what we already have i think that’s the way forward well gentlemen we could have continued this conversation but unfortunately we’re out of time but uh but this gives us room to continue with this conversation on a later date thank you very much for joining us with very valuable and meaningful insights on what has been announced today really means for the economy for the taxpayer as well as the tax department .

what we need to be mindful of as these promises are moved towards execution rajivani dinesh khanna always a pleasure many thanks for joining us here on ntaexamresults Transparent Taxation in hindi and Transparent taxation kya hai Blog. Thanks a lot

2 thoughts on “Transparent Taxation Scheme || Transparent Taxation honouring the honest in Hindi”